Corporate Governance

Suzuken’s basic philosophy regarding corporate governance

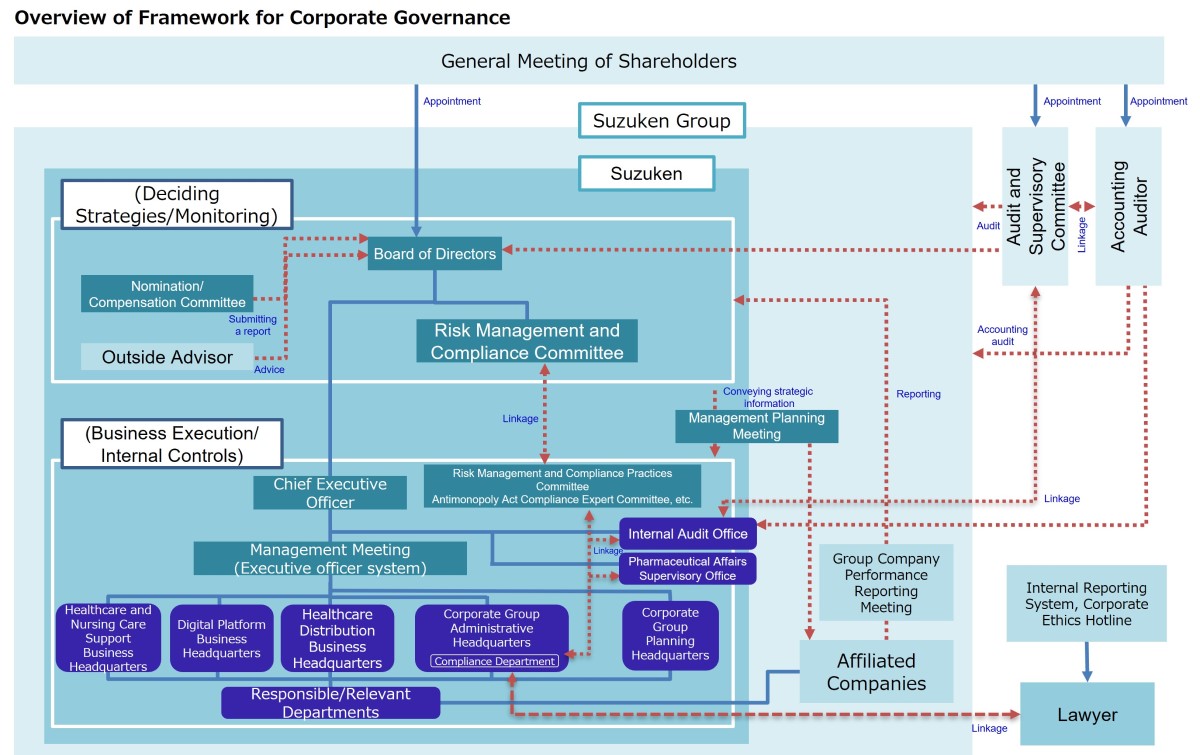

The Suzuken Group positions the strengthening of corporate governance as an important theme of management. Moreover, through efforts focused on strengthening our managerial systems, strengthening our risk management systems, and promoting disclosure and accountability, we endeavor to increase stakeholder trust in our group and achieve our continued and sound development.

State of corporate governance

Corporate Governance Report (636KB) Report date : June 25, 2024

Strengthening our management framework

Suzuken employs a system in which the Board of Directors is responsible for the oversight of management and the decision-making process and executive officers are responsible for performing business operations. We have terminated the retirement benefit system for directors and corporate auditors, reduced the number of directors, and established a compensation system that is linked to the company's performance and each individual's contributions. In addition, at the conclusion of the 75th General Meeting of Shareholders held on June 25, 2021, we transitioned to the system of a company with an Audit and Supervisory Committee, with the aim of further enhancing the company's corporate governance and strengthening the supervisory and check functions of the Board of Directors.

For the management of subsidiaries, we supervise and audit the performance of executives and employees of subsidiaries. The primary measures are sending directors and corporate auditors to subsidiaries, receiving reports and approving decisions as required by the related company management rules, and periodically auditing subsidiaries by using Suzuken’s Audit and Supervisory Committee, Internal Audit Office and accounting auditor.

Furthermore, each subsidiary has an internal control system and guidance program that reflects the characteristics of its business operations.

-

※The committees are not committees as legally defined.

Board of Directors

The Board of Directors examines important matters and reaches decisions in accordance with laws and regulations, the Articles of Incorporation, the Board of Directors Rules and other internal rules. The board also oversees the performance of the directors and executive officers.

To ensure that directors’ decisions are proper and verify the legality and suitability of how they perform their duties, four Audit and Supervisory Committee members (including three outside directors) attend all meetings of the Board of Directors. At board meetings, these four individuals express their opinions and perform supervision and oversight from many perspectives.

Audit and Supervisory Committee

The Audit and Supervisory Committee meets once each month, in principle, and holds other meetings as required.

Audit and Supervisory Committee members attend meetings of the Board of Directors and other important meetings. Attendance is based on Audit and Supervisory Committee audit standards prescribed by the Audit and Supervisory Committee and the fiscal year audit policy and audit plan. In addition, these members receive information about the performance of duties from directors, executive officers, the internal audit division, and other units, and they also check documents concerning important decisions and other documents. Furthermore, responsibilities include audits at the head office, major business sites, and subsidiaries concerning operations and assets and the proper establishment and operation of compliance, risk management, and other internal control systems. Reports are also received from subsidiaries as required.

In addition, to reinforce the monitoring function, Suzuken has appointed three outside directors as Audit and Supervisory Committee members. These outside directors consist of an expert in law, an expert in accounting, and a person with experience in business management. We have also appointed one internal director who has been involved in sales and marketing department work for many years and who has extensive knowledge and experience related to the operations of the Company.

Nomination and Compensation Committee

To discuss nomination and compensation for the directors, executive officers, associate directors, and trustees, the Company has established the Nomination and Compensation Committee, comprising a total of five members, which consists of one representative director, one internal director and three outside directors, who are appointed by the Board of Directors. The majority of the committee members are comprised of outside directors, for the purpose of ensuring the transparency and objectivity of the committee. The chairperson of the committee is appointed by the Board of Directors from among the committee members.

This committee was not established in accordance with any law or regulation.

Corporate governance highlights (FY 2023)

| Organizational form |

Company with Audit and Supervisory Committee System |

|---|---|

| Term of directors | 1 year |

| Implementation of an executive officer system | Yes |

| Implementation of performance-based compensation system | Yes |

| No. of Board of Directors meetings | 17 |

| No. of Audit and Supervisory Committee meetings | 15 |

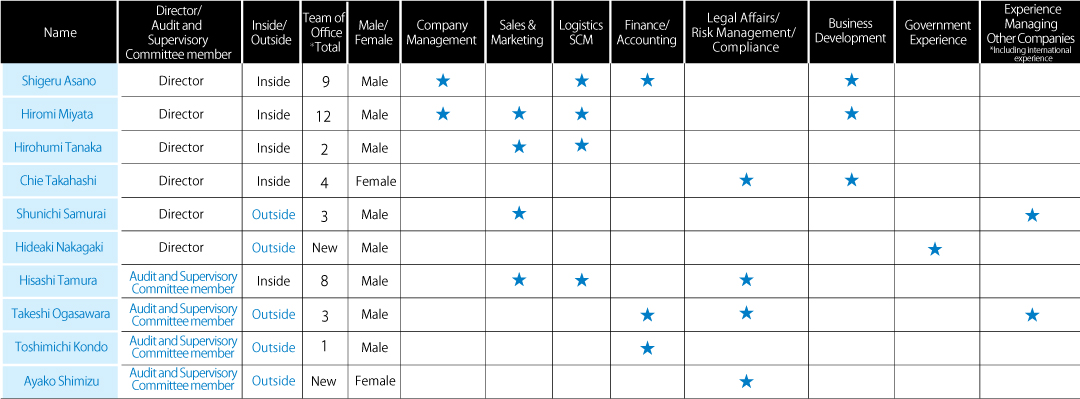

Board composition

The Company’s Board of Directors convenes meetings once a month, in principle, and practices swift, efficient decision-making. Board members have been chosen without regard to factors such as gender or age, and they include internal directors with a wealth of knowledge and experience regarding the Company’s businesses, as well as outside directors with exceptional expertise and insight. The Board’s composition, therefore, is characterized by diversity and appropriate size (limited to a maximum of 14 members as stipulated in the articles of incorporation, including nine or less directors, but not directors who are Audit and Supervisory Committee members, and five or less directors who are Audit and Supervisory Committee members), and the Board considers multiple perspectives in making decisions and in overseeing and monitoring business activities. Outside directors account for half the members of the Board of Directors.

A system of oversight and monitoring by the Audit and Supervisory Committee has been established. Audit and Supervisory Committee members include an experienced company manager, an attorney with exceptional professional expertise, and a certified public accountant.

(Reference) Skill matrix for directors (excluding directors who are Audit and Supervisory Committee members) and directors who are Audit and Supervisory Committee members

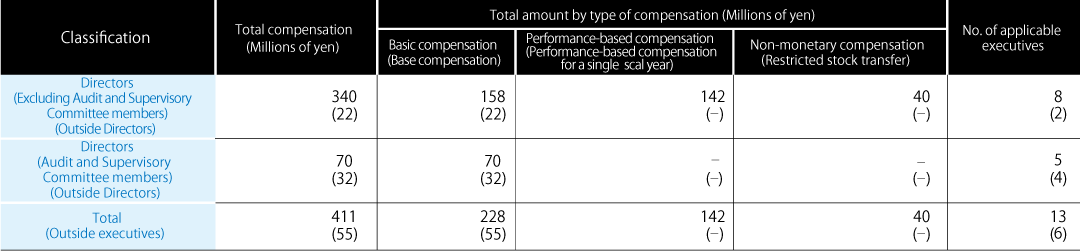

Elements of executive compensation

In its June 13, 2016 meeting, the Board of Directors established policies for the individual compensation of directors. Regarding director compensation, we have implemented an overall evaluation system using performance indicators for the entire company and for the areas under the responsibility of individual directors. This system is based on the Director, Executive Officer, and Counselor Evaluation Bylaws and the Director, Executive Officer, and Counselor Compensation Bylaws. To ensure objectivity and transparency, the Nomination / Compensation Committee, which advises the Board of Directors and consists mostly of outside directors, deliberates compensation matters and submits its opinions to the Board of Directors, which respects them in making its decisions. The compensation system consists of two divisions, a fixed compensation and compensation linked to the company’s performance. All directors, except for outside directors who only receive fixed compensation, are subject to the same system.The proportion of compensation is set high for performance-based pay, reflecting the company’s performance.

The total amount of compensation for directors in the fiscal year 2023 is as follows:

-

※Based on the resolution of the 75th General Meeting of Shareholders held on June 25, 2021, Suzuken transitioned from a company with a Board of Company Auditors to a company with an Audit and Supervisory Committee.

Cross-shareholdings

Suzuken’s basic policy on cross-shareholdings is to hold shares of companies that will help to increase its corporate value, as a means of building, maintaining, and strengthening transactional and collaborative relationships. The Board of Directors examines individual cross-shareholdings to determine whether they are appropriate.

Regarding the reduction in cross-shareholdings, we formulated and disclosed our reduction policy for the first time in May 2021, and have continued to work on reduction since then.

In the current medium-term management plan, we have set a policy to reduce cross-shareholdings to 10% or less of consolidated net assets by the end of the fiscal year ending March 31, 2025. As part of this effort, in the fiscal year ended March 31, 2024, we have reduced approximately ¥9.2 billion across eight brands (including pharmaceutical companies and the Misonoza Theatrical Corporation), and we will continue to work toward this goal.

Since announcing the above policy, we have reduced a total of 25 brands (including partial sales), amounting to approximately \22 billion.

In exercising its voting rights related to cross-shareholdings, the Company makes a comprehensive judgment based on whether or not the proposal will lead to the increase of its corporate value in the medium-to long-term, and whether it will lead to shared benefit for the shareholders of the company concerned.